take home pay calculator maryland

Payroll Schedules Salary Scales Forms Contact Information. This version of Net Pay Calculator should be used by those who submitted Federal W-4 in 2020 or later.

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

Well do the math for youall you need to do is enter.

. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Maryland. The latest budget information from April 2022 is used to. You need to do these steps.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local. Next divide this number from the. Tax Rate Threshold Tax Due in Band.

This net pay calculator can be used for estimating taxes and net pay. Use Smartassets Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs After Taking Into Account Federal State And Local. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

It can also be used to help fill. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Maryland. After entering it into the calculator it will perform the following calculations.

Thats the five steps to go through to work your paycheck. Annual Income for 2022. Simply enter their federal and state W-4 information as.

Luckily our payroll tax calculator is here to lessen the burden of calculating payroll taxes so they almost seem free. Maryland State Tax Tables. Calculate your Maryland net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Maryland.

Supports hourly salary income and multiple pay frequencies. This is only an. How do I calculate hourly rate.

Calculate your Maryland net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. To use our Maryland Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

The Maryland Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Maryland State. Simply input wage and W-4 information for each. Filing 6000000 of earnings will result in 618750 of that amount being taxed as federal tax.

If your household has. Home Maryland Taxes Marylands Money Comptroller of Maryland Media Services Online Services Search. Maryland Paycheck Calculator Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay.

This Maryland hourly paycheck. You need to do these steps separately for federal state and local income taxes. Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Calculating your Maryland state income tax is similar to the steps we listed on our Federal paycheck calculator. After a few seconds you will be provided with a full breakdown.

Maryland Paycheck Calculator Use ADPs Maryland Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. Maryland State Tax Calculation for 90k Salary.

For a single filer with an annual wage of 80000 in Baltimore City the total take home pay after. Just enter the wages tax withholdings and. Take home pay calculator maryland.

Figure out your filing status work out your adjusted gross income Total. Total annual income Tax liability All deductions Withholdings Your annual paycheck.

Maryland Property Tax Calculator Smartasset

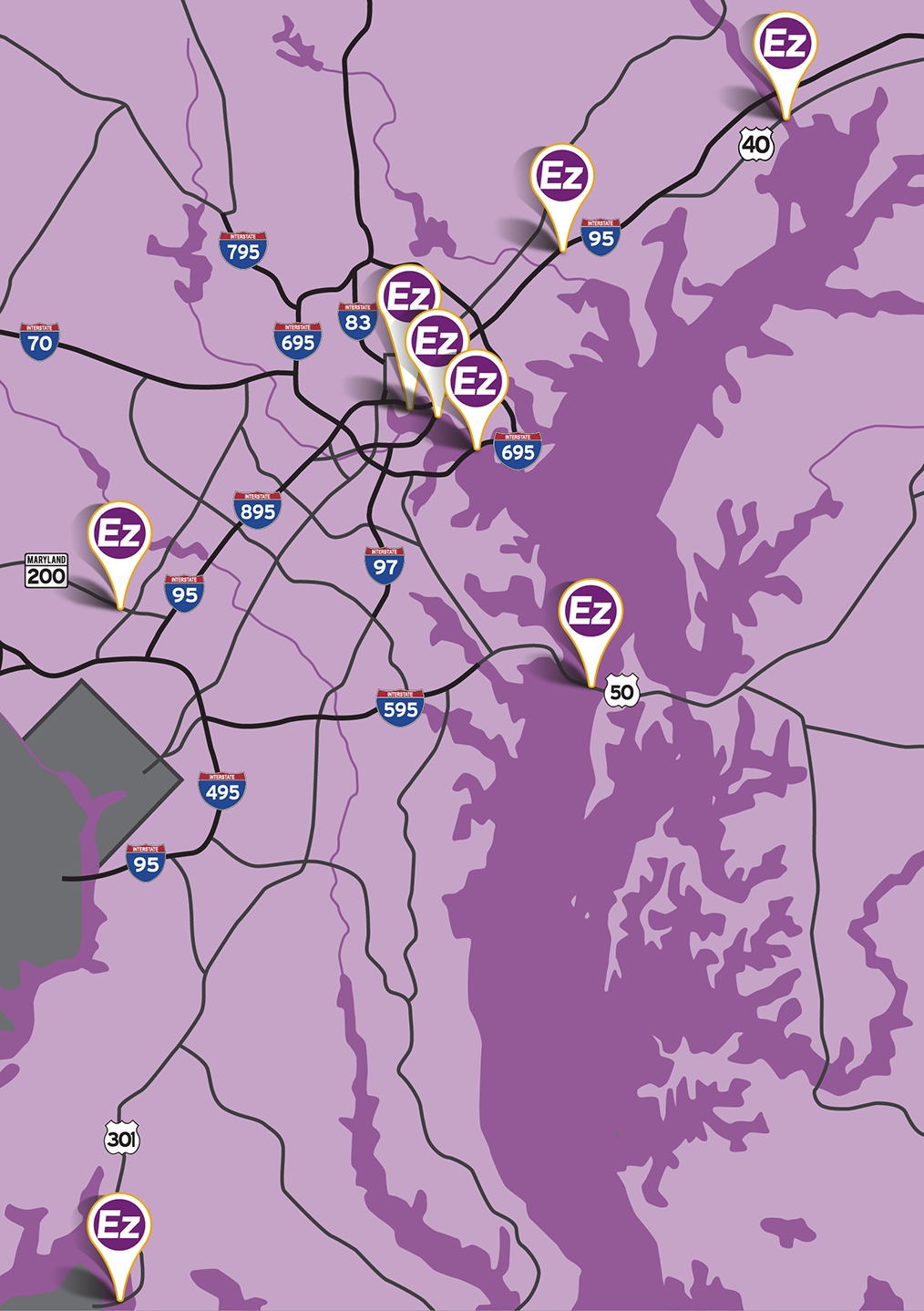

Maryland E Zpass Toll Rate Calculator Driveezmd Com

Towns At Wade S Grant New Townhomes In Millersville Md K Hovnanian Homes New Construction Luxurious Kitchens Home Builders

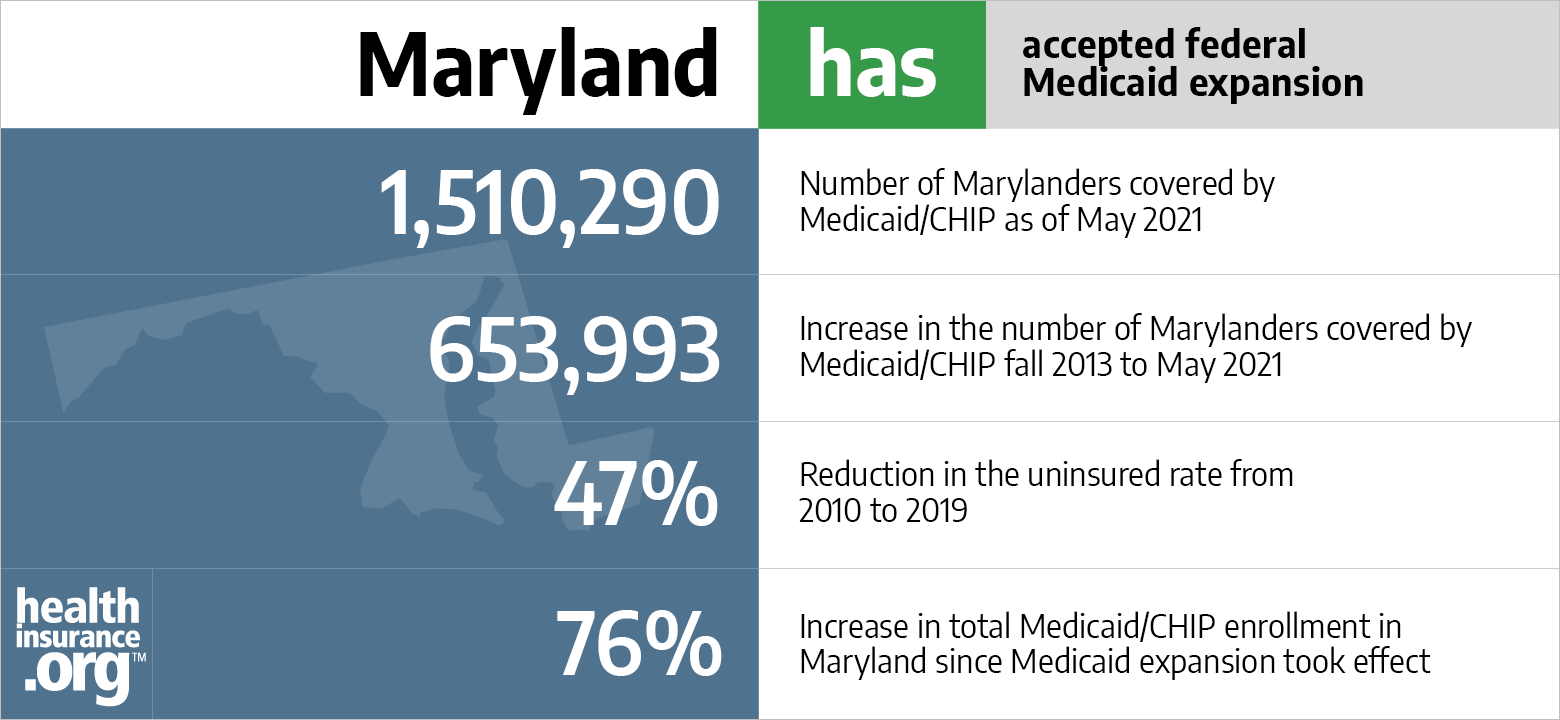

Aca Medicaid Expansion In Maryland Updated 2022 Guide Healthinsurance Org

Maryland Paycheck Calculator Smartasset

Trulia Mortgage Center Goes Live Agbeat Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage

Download Simple Child Support Calculator For Wordpress Free Wordpress Plugin Https Downloadwpfree Com Download S Supportive Child Support Daycare Costs

Salary To Hourly Salary Converter Omni Salary Paycheck Finance

Maryland Sales Tax Guide And Calculator 2022 Taxjar

Learn How To Pay Off Your Home In 5 7 Years And Determine Your Debt Free Date With This Heloc Cal Mortgage Calculator Tools Online Mortgage Mortgage Calculator

Sell My House In Md Homes Are Selling Fast Across The Selling House Real Estate Infographic Real Estate Trends

Maryland Retirement Tax Friendliness Smartasset

Maryland Payroll Tools Tax Rates And Resources Paycheckcity

Calculate Child Support Payments Child Support Calculator Proud Maryland Girl Child Custody Cal Cool T Shirts Child Support Quotes Child Support Payments

A Call To Arms In The Maryland State Capital To Preserve Home Ownership Home Ownership Mortgage Interest State Capitals

The Average Monthly Rent Rose 5 5 In The Last 12 Months Alone On The Other Hand Monthly Costs Naturally Stay Rel Real Estate Rent Vs Buy Home Buying Process

Maryland Paycheck Calculator Smartasset

New Survey Reveals Pulse Of 2014 Spring Real Estate Market Maryland Real Estate Real Estate Infographic Real Estate Marketing